This is the first story of a three-part series. Click here to read the second, and click here to read the third.

WASHINGTON ― A bipartisan group of U.S. lawmakers traveled to Britain this spring in an effort to get tough on China.

But House China committee Chairman Mike Gallagher, R-Wis., and his delegation quickly found their British counterparts had another matter top of mind: AUKUS, the trilateral nuclear-powered submarine agreement with Britain and Australia.

Officials from those countries made clear to Gallagher and other U.S. lawmakers that Congress must take steps to ensure the deal is a success. Specifically, they want lawmakers to approve a blanket exemption for the U.K. and Australia within Washington’s stringent export control regime. That policy, the International Traffic in Arms Regulations, or ITAR, sets rigorous restrictions on sensitive defense exports. Without ITAR exemptions, they worry the pact won’t succeed.

“The thing we heard most consistently from our allies in Britain is that ITAR is a roadblock for cooperation with them,” Gallagher told reporters. He said a “a free-world approach” to AUKUS is critical.

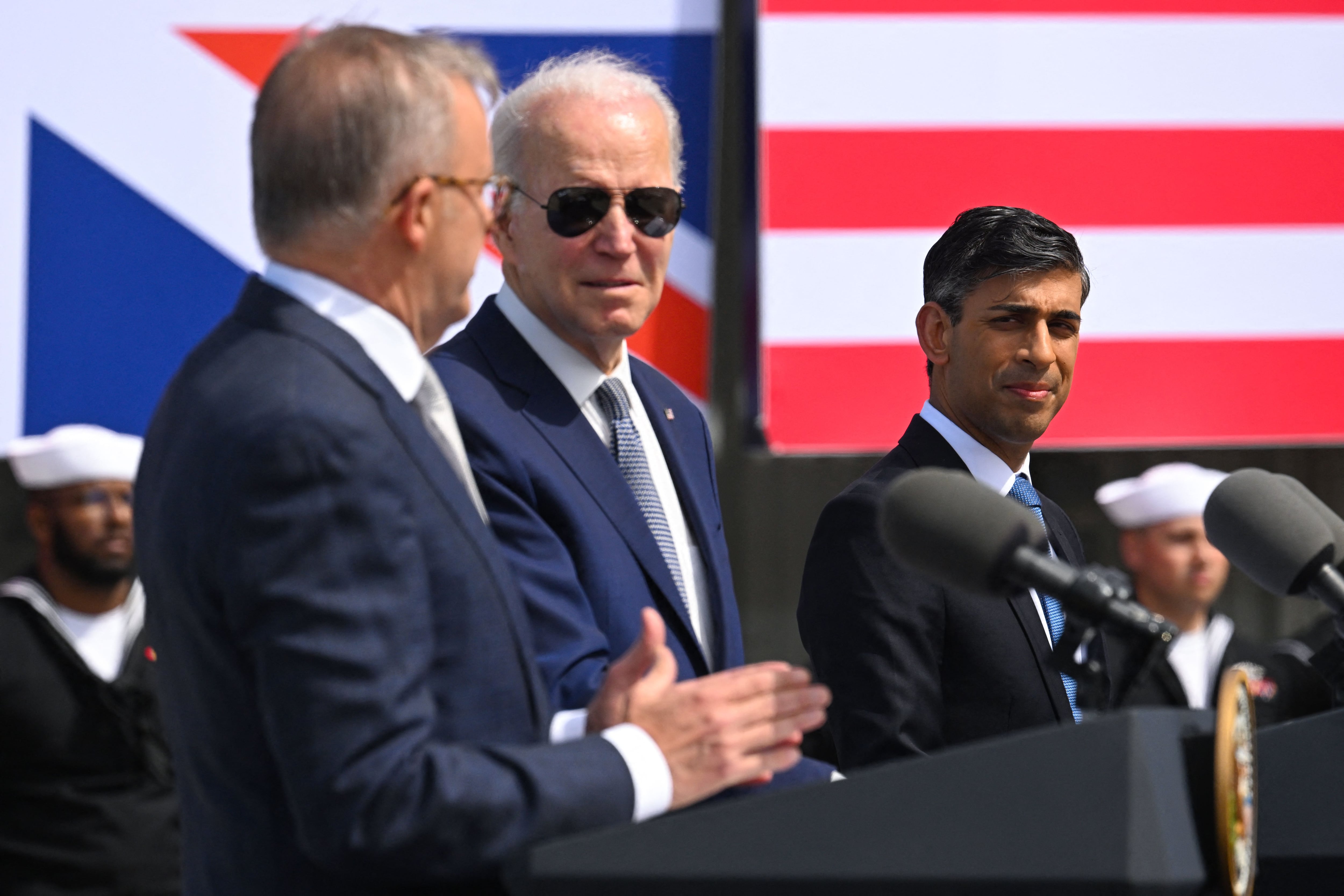

The AUKUS agreement is intended to draw the three countries’ defense industries closer together by helping Australia develop its own nuclear-powered submarine fleet while sharing top secret technology among the allies. If it works, the program will develop cutting-edge capabilities that will influence the future of warfare.

While visiting Australia in August, Gallagher said “long-overdue ITAR reform” could lead to joint U.S.-Australian munitions production and hypersonic weapons development, “turbocharging AUKUS.”

Critics of existing U.S. export control laws, like Gallagher, argue reform is necessary to increase cooperation among the three countries’ defense-industrial bases, a goal the Biden administration is also eager to pursue. But the push to overhaul ITAR has faced resistance, with the State Department and Democrats arguing the export control policy is crucial to keeping defense industry secrets from falling into the hands of rivals such as China.

As the two-year anniversary of AUKUS approaches, the export control debate and a separate tussle over the health of the submarine-industrial base have raised questions about how and when Congress will pass several authorizations needed to make the program into the transformational initiative leaders promised.

Republicans and the defense industry say if Congress does not pass an ITAR exemption for the U.K. and Australia, it will stymie joint development of disruptive technology such as hypersonic weapons, artificial intelligence and quantum computing. The Pentagon had also hoped Congress would approve the transfer of Virginia-class submarines to Australia this year in order to illustrate the country’s commitment to the pact and to pave the way for Canberra to prepare for its future fleet.

But those efforts have stalled while Senate Republicans push for additional funding for the submarine-industrial base beyond the $647 million the Biden administration requested for fiscal 2024.

“You cannot have an effective transfer of Virginia-class submarines to Australia without systemic change to U.S. export control, tech transfer and information sharing processes as they apply to Australia,” said Ashley Townshend, a senior fellow for Indo-Pacific security at the Carnegie Endowment for International Peace think tank.

“Australia has ripped up a deal with France to pursue a submarine agreement with Britain and the United States. It cannot begin to address — either independently or trilaterally — the gamut of industrial base, workforce, defense planning and nuclear stewardship requirements of the SSN project until it has assurances the deal is done,” he told Defense News, using an abbreviation for attack submarines.

‘Layers of red tape’

AUKUS has paved the way for Australia to acquire its own nuclear-powered submarine fleet, but it won’t be ready until the 2040s. In the meantime, all three AUKUS countries are eager to jump-start collaboration on emerging technologies that could prove key to future warfare.

This initiative has revived a two-decade-old export control dispute among the three allies.

“Our allies actually have technology which is as good, if not better, than us,” said Bill Greenwalt, a former U.S. deputy undersecretary of defense for industrial policy who is now a nonresident senior fellow at the American Enterprise Institute think tank. “There are huge disincentives for our allied countries to share that with the United States or work with us in any manner because of the stickiness of U.S. export controls, the extraterritorial application of export controls.”

“Because of that, what we’re seeing is the creation of greater ally technologies that exempt U.S. content or even U.S. participation,” he added.

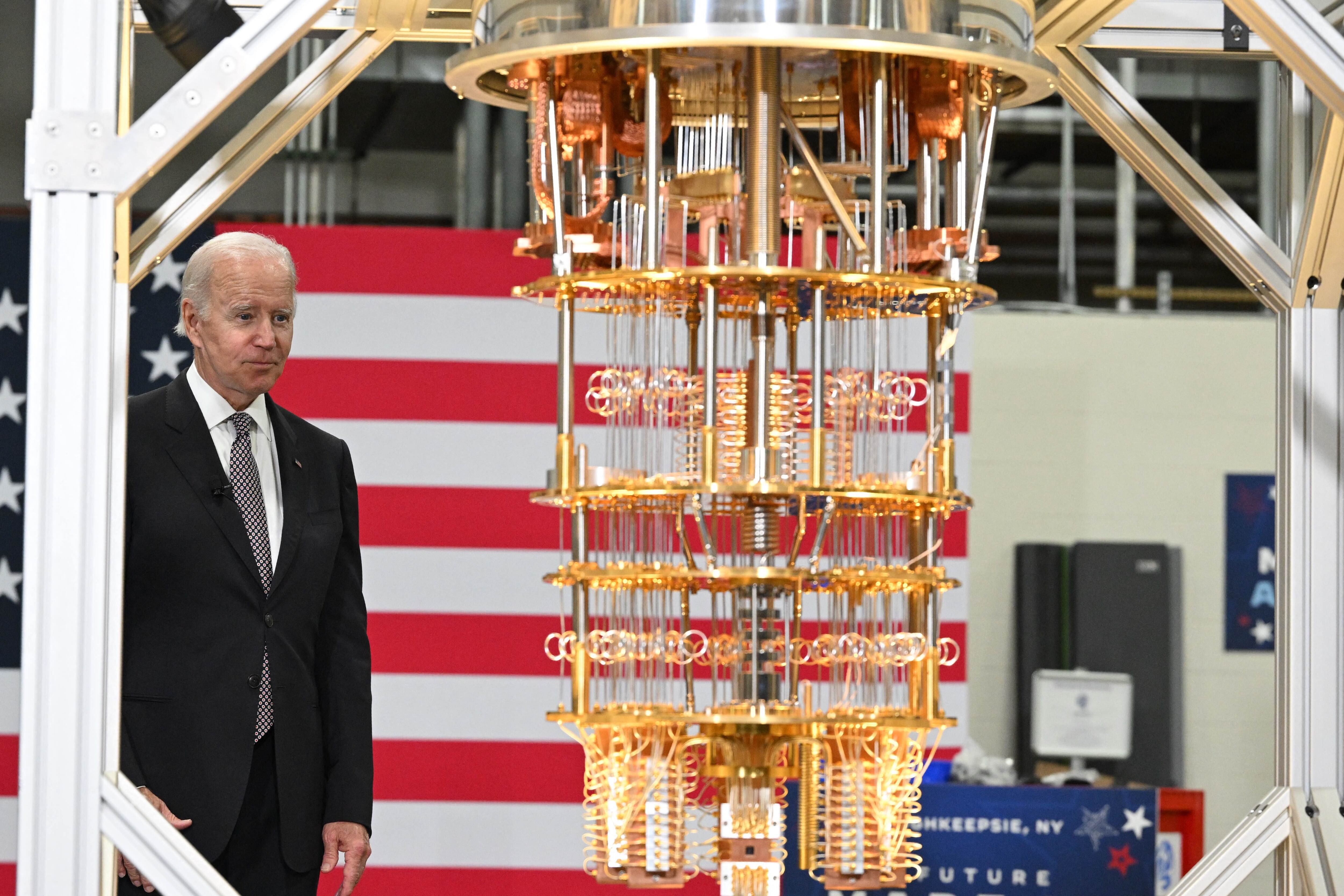

The Australian Defence Department in July announced a partnership with a startup technology firm specializing in quantum technology, Q-CTRL. The company, which also has offices in the U.S. and Britain, is developing a navigation capability for military platforms — including nuclear submarines — to serve as an alternative to GPS.

The head of Q-CTRL, Michael Biercuk, warned a failure to overhaul ITAR would “isolate the United States” within AUKUS. For example, he noted that ITAR hinders employees at Q-CTRL’s Los Angeles, California, office from collaborating on the technology it’s pioneering in Australia.

“The United States will not be able to partner with Australia and the U.K. in this,” Biercuk said. “If we really want cross-border participation among these very friendly nations in this area of critical technology, we just have to remove this one roadblock. Everybody wants to avoid engaging with the United States because ITAR is very difficult to comply with.”

For years, Canada has been the only U.S. ally to enjoy the special ITAR exemption Britain and Australia now seek.

The U.S. ratcheted up export control laws after China and Iran took advantage of Canada’s ITAR exemption in the 1990s to circumvent Washington’s arms transfer regulations. China used Canada to purchase infrared equipment from a U.S. firm, while Iranian front companies used the country to buy American weapons.

The incidents prompted the U.S. State Department to revoke Canada’s ITAR exemption in 1999, only to restore it in 2001 after the northern neighbor strengthened its laws, harmonizing its export control list with U.S. regulations.

Feeling impeded by the enhanced ITAR regulations, Britain and Australia persuaded the George W. Bush administration to lobby Congress to give both countries the same ITAR exemption as Canada. Bush’s fellow Republicans on Capitol Hill blocked this effort, insisting London and Canberra first bolster their own export control regimes. Neither country did so, and in 2010 the Senate ended up ratifying separate defense cooperation treaties with each country that fell short of the Canada exemption.

Defense firms in AUKUS countries argue these treaties have not significantly reduced the export control barriers that could slow progress on the pact.

Townshend said an export control overhaul is also needed to make the submarine portion of AUKUS work because specific, individual components for the vessels “would all trip up different kinds of export control regulations, tech transfer and information sharing regulations.”

Current export control laws also mean Britain and Australia need specific, individual licenses for most defense transfers, ranging from taking a weapon sold to an allied navy and repurposing it for use by the country’s air force, to sharing military tactics manuals for items like the Tomahawk missile system.

The U.S. government approves almost all these licenses, though that process can take nearly a year in some cases. Britain estimated in 2017 it spends about $500 million annually on ITAR compliance.

“Export control reform within and between AUKUS nations is key to removing the layers of red tape, unnecessary delays, and compliance costs that currently face our government and our industries,” Claire Bates, a spokeswoman for the British Embassy in Washington, told Defense News.

The Australian Defence Department did not reply to Defense News’ requests for comment.

House Foreign Affairs Committee Chairman Mike McCaul, R-Texas, has been receptive to these concerns. Republicans on his panel advanced legislation in July to give both countries a Canada-style ITAR exemption, over Democratic objections.

“There’s too much bureaucracy within the ITAR system,” McCaul told Defense News.

This goes further than the State Department’s June legislative proposal, obtained by Defense News. That proposal asked Congress to give Australia and Britain the ITAR exemptions only if the two countries enhance their own export control regimes so that they “are at least comparable to those administered by the United States.”

Democrats have sided with the State Department, which oversees ITAR, arguing China could take advantage of loosened export control laws.

The top Democrat on the House Foreign Affairs Committee, Rep. Gregory Meeks of New York, noted in July that “the targeting of Australian defense industry insiders and experts has increased since AUKUS’ announcement” and that “the U.K. faces similar intelligence threats.”

Mike Burgess, the director general of the Australian Security Intelligence Organisation, warned in February of an uptick in online espionage attempts aimed at the country’s defense industry since AUKUS was announced in September 2021.

“Third-party companies have offered Australians hundreds of thousands of dollars and other significant perks to help authoritarian regimes improve their combat skills,” Burgess said.

Senate Foreign Relations Committee Chairman Bob Menendez, D-N.J., attached a different approach to ITAR reform as an amendment to the FY24 defense policy bill, which passed 86-11 in July.

Menendez’s legislation gives the State Department more discretion as to whether, and how broadly, to implement an exemption for Britain and Australia under ITAR, setting up a possible showdown this year between the House and Senate on AUKUS export control.

For its part, the White House has helped lead the charge for some degree of export control reform.

“This is not a ‘whether to,’ it’s a ‘how to,’ ” Kurt Campbell, the National Security Council coordinator for the Indo-Pacific, said in June. “Sometimes that simple, crystallized fact helps quite a lot in complex bureaucratic situations. So we’re under clear instructions to move in that direction.”

In the meantime, the State Department has established an AUKUS Trade Authorization Mechanism as an interim capability to speed up the transfer of certain technologies.

A State Department fact sheet issued in July noted there are already more than 50 exemptions within ITAR that don’t require a license for close allies. It defended the export control regime as necessary because of “malign actors” seeking to acquire cutting-edge U.S. technology like “an AI algorithm capable of creating drone swarms.”

‘Knitted together’

Despite misgivings about ITAR, U.S. defense companies have shown a keen interest in Australia.

“When you can find ways to collaborate with your closest allies, to knock down barriers to cooperation, technology, development, interoperability, getting these defense-industrial bases kind of knitted together, you’re going to incentivize a whole bunch of interesting things,” Mara Karlin, the U.S. assistant secretary of defense for strategies, plans and capabilities, told a Defense Writers Group roundtable in August.

Defense Secretary Lloyd Austin and Secretary of State Antony Blinken in July met with their Australian counterparts in Canberra and announced the U.S. would help Australia make guided-missile rockets for both countries by 2025. Lockheed Martin and RTX, formerly called Raytheon Technologies, will produce the Guided Multiple Launch Rocket Systems in Australia for both countries.

The White House and the Pentagon have also asked Congress to make British and Australian companies eligible for U.S. federal grants under the Defense Production Act — another advantage only enjoyed by Canada — arguing it will help advance AUKUS. U.S. President Joe Biden promised Australian Prime Minister Anthony Albanese during a May meeting that the U.S. would do this, but Congress has not acted on this legislative request from the Pentagon since then.

Anthony Di Stasio, who oversees Defense Production Act grants at the Pentagon, said adding Canberra would help bolster U.S. supply chains for critical minerals like cobalt — abundant in Australia — and explosive materials like TNT.

Prior to Russia’s invasion, Ukraine was one of the Pentagon’s only three qualified TNT suppliers, with the other two in Poland and Australia. Di Stasio noted the U.S. military is using less TNT every year, so it would be cheaper to use Defense Production Act grants to expand Australian facilities than to build a U.S. plant from scratch.

Similarly, the proposal would allow U.S. grants to fund cobalt mining activities in Australia. China dominates most of the world’s market for cobalt, needed to make batteries as well as hard-target penetrators for the military.

Di Stasio hopes putting Britain and Australia under his office’s purview will allow them to participate in a pilot program he envisions to create U.S. campuses for businesses to collaborate on different parts of the defense supply chain.

“I want their [intellectual property] protected, but [for] them to be able to combine technology,” Di Stasio told Defense News in June. “If you have someone doing 3D-printed rocket cases and someone else has a new whiz-bang rocket propellant, they can be on the same campus testing it.”

Other countries could benefit as well.

On a trip to New Zealand, Blinken told reporters “the door is open” for the Five Eyes ally to join AUKUS. That intelligence sharing alliance is made up of Australia, Canada, New Zealand, the U.K. and the U.S.

Additionally, the U.S. and India have launched their Initiative on Critical and Emerging Technology. The White House pledged to work with Congress “to lower barriers to U.S. exports to India” for artificial intelligence and quantum computing when Biden hosted Prime Minister Narendra Modi in June.

The National Security Council’s Campbell said the U.S. is looking for non-AUKUS countries to offer “niche areas” when collaborating with the three allies on disruptive technology.

“We’re not just looking for theoretical applications and partnerships, but practical, real efforts that will enhance defense capabilities,” he said. “We are in conversation with a variety of countries who are interested.”

‘A real commitment’

Congress’ path to authorizing submarine transfers to Australia appeared more straightforward than the export control effort, until it became embroiled in a broader fight over U.S. defense spending levels.

Australia plans to buy at least three and as many as five Virginia-class submarines in the 2030s. But AUKUS proponents had hoped to start authorizing those sales this year to demonstrate allegiance to the pact, particularly as Australia has agreed to invest $3 billion in the U.S. submarine-industrial base.

Australia is waiting on Congress to pass authorizations for the nuclear submarine transfer before work begins on the infrastructure necessary to sustain the vessels.

“This is already a hugely ambitious undertaking for both countries, and for Australia it will require us to move at an extremely fast pace toward building out the domestic nuclear stewardship, infrastructure, submarine production facilities and so forth,” Townshend said.

Republicans and Democrats on the House Foreign Affairs Committee rallied together in July to unanimously advance an authorization to transfer up to two Virginia-class submarines to Australia.

“The transfer language really shows a real commitment by Congress,” Rep. Joe Courtney of Connecticut, the top Democrat on the House Armed Services Committee’s sea power panel, told Defense News. “Australia is prepared to make investments we want to make in terms of building up Virginia production tied to this AUKUS goal post.”

The Senate was set to attach the same authorization to the defense bill in July, until the top Republican on the Senate Armed Services Committee, Sen. Roger Wicker of Mississippi, blocked it. He also held up a separate authorization that would allow the Pentagon to accept Australia’s contributions to the U.S. submarine-industrial base.

However, he didn’t hold up a third authorization allowing the U.S. to begin training Australian private sector personnel in nuclear submarines, which the Senate passed as part of its defense policy bill.

While blocking the other two authorizations, Wicker cited concerns about the industrial base’s current struggle to keep up with submarine production requirements. He wants Congress to add money for the submarine-industrial base as part of a supplemental defense spending package before passing the authorizations.

The senator argues more submarine spending will strengthen AUKUS, given production capacity isn’t keeping pace with the U.S. Navy’s goal of building two Virginia-class attack submarines and one Columbia-class ballistic submarine per year. Right now, the country is producing approximately 1.2 Virginia-class vessels per year.

Senate Majority Leader Chuck Schumer, D-N.Y., and Minority Leader Mitch McConnell, R-Ky., in June promised to pass a Pentagon supplemental spending bill to circumvent the $886 billion defense funding top line agreed to as part of the debt ceiling deal. But House Speaker Kevin McCarthy, R-Calif., has expressed opposition to additional defense spending beyond the debt ceiling cap.

Half of the Senate GOP caucus, including McConnell, raised the submarine issue in a letter to Biden led by Wicker and top Republican appropriator Sen. Susan Collins of Maine.

“The administration’s current plan requires the transfer of three U.S. Virginia-class attack submarines to Australia from the existing U.S. submarine fleet without a clear plan for replacing these submarines,” the senators wrote. “This plan, if implemented without change, would unacceptably weaken the U.S. fleet even as China seeks to expand its military power and influence.”

They added that sending three attack submarines to Australia would require the U.S. to produce 2.3 to 2.5 Virginia-class vessels per year to “avoid further shrinking our fleet’s operational capacity.”

Courtney — whose district encompasses the Electric Boat shipyard building the Virginia-class submarines — argues the production setbacks were in large part due to the COVID-19 pandemic, and that the massive investments Congress has already made in the industrial base is bringing the program up to speed. He noted the U.S. is on track to meet its annual submarine production requirements by 2028 “with continued support from Congress and improved performance in the industrial base.”

“We put in money and capital expenditures to help these companies, as well as the workforce hiring,” Courtney said. “I am very bullish about the fact that the pace is really picking up.”

Lawmakers allocated nearly $750 million for the submarine-industrial base in FY23. The House’s FY24 defense policy bill, which passed in July, would inject another $735 million into that industrial base.

Despite the legislative complications, Townshend remains optimistic Congress will pass all its necessary AUKUS legislation this year — export control exemptions and submarine transfer authorities included.

Still, there’s little room to dally.

“The timeline for the optimal pathway is extremely tight,” he said. “If the language that allows both sides to move ahead with ship transfer and funds does not proceed this year, then that will inevitably delay the ability of both countries to meet their obligations.”

This is the first story of a three-part series. Click here to read the second, and click here to read the third.

Bryant Harris is the Congress reporter for Defense News. He has covered U.S. foreign policy, national security, international affairs and politics in Washington since 2014. He has also written for Foreign Policy, Al-Monitor, Al Jazeera English and IPS News.