Skyrocketing costs nationwide for housing, food and other necessities have prompted defense officials and lawmakers to make major changes to pay and benefits for troops and veterans over the past several years.

Service members saw a 5.2% pay increase in 2024, the biggest annual bump in 22 years. The Basic Allowance for Housing increased by 5.4% on average. Defense officials are also adding and expanding some benefits to improve the quality of life for service members and families.

Whether it’s health care, retirement benefits, family support and child care, VA benefits or a plethora of other programs, getting smart about the rewards you have earned is worth your time.

— Karen Jowers, Leo Shane III and Meghann Myers

Basic Pay Housing Allowance Basic Needs Allowance Retirement Pay Tricare Changes Life Insurance Spouses and Children Buying a Home GI Bill and Tuition Commissaries and Exchanges

Basic pay on the rise

Service members saw their biggest pay raise in 22 years this past January. The pay bump in 2025 likely won’t be as large for all troops, but some junior personnel could get a windfall if lawmakers follow through on recent promises.

Basic pay is determined by a person’s rank and length of service, with automatic raises when troops meet certain time and promotion markers. Congress also determines how large of a pay raise all troops should receive each year.

The figure is tied by law to the anticipated increase in private-sector pay, but lawmakers in the past have approved bigger raises to help with recruitment and retention, or smaller raises to save money for other military priorities.

The most junior enlisted service members make around $24,000 a year in basic pay (not including allowances, special pay and other benefits), while enlisted troops nearing retirement typically earn about $70,000 annually.

Officer pay is significantly higher: Junior officers earn close to $40,000 a year, while senior officers nearing 20 years of service can make in excess of $170,000. That means that even a small change in the anticipated pay raise calculations can make a big difference for military families.

The annual military pay increase takes effect in January each year. The White House issues its target for the hike each August, either going along with the projected rise in private-sector wages, known as the Employment Cost Index, or offering justification for proposing a different rate.

Congress has the final say. In the past, lawmakers have overridden attempts by the White House to submit lower pay raises that would save money for other priorities. But in recent years, the executive and legislative branches have been in sync on the annual pay raise.

Targeted pay raises

The military pay raise usually applies equally to all troops, though lawmakers made an exception at the height of the wars in Iraq and Afghanistan to provide more money for some mid-career service members to help with retention.

That could be the case again in 2025. Last year, House lawmakers considered a plan to give additional targeted pay raises to junior enlisted troops, ensuring that even the newest service members would be guaranteed an annual base pay of $31,000. The plan ultimately failed in Congress.

But members of the House Armed Services Committee are considering similar language again this year as part of the annual defense authorization bill debate.

So far, the White House has not supported those plans. Officials there have pointed to an ongoing military compensation review by Pentagon leaders that is scheduled to be completed in early 2025, and have pushed to delay any major military pay overhauls until then.

Troops should know what congressional pay proposals are likely to be at the center of this year’s Capitol Hill debates by early summer. House and Senate lawmakers are expected to spend most of the summer negotiating that authorization bill, with an eye towards final passage ahead of the November presidential election.

Even if lawmakers do adopt major changes to military pay, the decisions are unlikely to take effect until January 2025 at the earliest.

2025 pay boost

Since the start of the all-volunteer military force in 1973, Congress has authorized a pay raise of at least 1% for troops every year, even during budget cycles where other civilian wages held steady. Those increases have grown to 2.5% or more since 2018.

The 2024 pay increase (which took effect Jan. 1) was 5.2% — the largest bump since 2002 and the second-biggest boost in 40 years.

That 5.2% pay boost matched the federal formula based on the annual Employment Cost Index calculation, and somewhat offset concerns about covering increased living costs over the last few years.

The ECI calculation for 2025 sits at 4.5%, which — if approved — would mark the third straight year of pay hikes above 4% for military members.

For junior enlisted troops, the proposed 2025 raise would mean about $1,600 more in take-home pay next year. For senior enlisted and junior officers, the raise would add about $2,700 more. An O-4 with 12 years of service would see almost $5,000 more over 2024 pay levels.

That raise is not guaranteed, but lawmakers have recently shown little interest in trimming back military pay. Congress has not adopted a raise below the ECI calculation since 2015.

Lawmakers are expected to debate the pay raise level along with the rest of the defense budget over the spring and summer. Congress typically fails to approve the federal budget until late in the calendar year, after each fiscal year begins Oct. 1. But the new pay raise still goes into effect on Jan. 1 each year.

Basic Allowance for Housing

The military’s housing stipend, known as the “basic allowance for housing,” increased by an average of 5.4% per person in January 2024. Whether a service member saw a larger or smaller increase than average depends on their location.

BAH rates are typically adjusted once a year and take effect Jan. 1. However, DOD in recent years has taken additional steps to ease the burden of surging housing costs on service members. The Pentagon provided temporary out-of-cycle increases in BAH for some hard-hit areas in 2021 and 2022; It also bumped up the rate by 12.1%, on average, in 2023 — the largest increase in 15 years.

Meanwhile, the military is continuing to study how BAH is calculated and whether the stipend meets the needs of service members.

What is BAH?

The Basic Allowance for Housing provides compensation for the housing costs of active duty troops stationed in the 50 U.S. states who do not live on government-owned property. Stipend amounts are tied to local market rates and depend on the recipient’s rank, whether they have dependents and where they are based.

The tax-free benefit is intended to cover 95% of the estimated average housing costs at each assigned duty post in the U.S., including utilities. Individual service members are expected to pay the remaining 5% of housing costs out of pocket. Congress or the Pentagon could boost the stipend to cover 100% of those projected expenses instead.

Most service members can choose where to live. Those living in privatized housing — owned and operated by civilian companies for the military — also receive BAH, but the allowance typically goes straight to their landlord each month.

If troops can find housing in the civilian community that’s cheaper than the BAH rate for their assigned location, they can pocket the difference. And if homes are more expensive than what BAH will cover, troops pay for the overage.

Those stationed in U.S. territories or overseas who are not provided government housing are eligible for an overseas housing allowance, which is calculated under a separate formula. That allowance partially offsets housing expenses at overseas duty locations when service members live in privately leased housing on the local economy.

How BAH is calculated

DOD conducts a survey to calculate median rental costs for 300 military housing areas, including Alaska and Hawaii. Calculations are based on the rental costs of a one- or two-bedroom apartment, a two- or three-bedroom townhome, and a two- or three-bedroom single family home. The BAH for junior enlisted, for example, might be based on the equivalent of a small apartment, while the allowance for more senior enlisted and officers might be based on the equivalent of a house.

Two rates — with and without dependents — are set for each location. Personnel with at least one dependent, whether a spouse or a child, qualify for the dependents rate. It does not increase for additional family members.

For dual-military couples with no children, both spouses get the without-dependents rate. If the couple has children, one spouse receives the with-dependent BAH rate, while the other gets the without dependents rate.

BAH varies widely. For example, an E-1 without dependents at Twentynine Palms receives $1,614 a month, while an O-4 with dependents stationed there gets $3,021. But across the country at Fort Sill, Oklahoma, an O-6 with dependents receives $2,025 a month, according to DOD.

For details of locations across the country, you can use the Defense Department’s official BAH calculator.

Service members receive BAH rate protection as long as they remain in their home, even if rates drop. However, if they move, are demoted or their dependency status changes, they would receive the rate for their new status.

If rates rise in a location, all service members receive the higher rates, regardless of when they arrived.

Find more information on BAH on DOD’s website.

Basic Needs Allowance

A new Basic Needs Allowance for low-income military families took effect Jan. 1, 2023. The payout is designed to serve as a safety net for individuals whose total family income, including the spouse’s income, falls below 150% of the annual federal poverty guidelines. But for many members, the housing allowance bumps them above the income threshold.

Service officials continually screen service members and notify those who may be eligible. Once people are told they could qualify, they must submit an application and go through a final income screening to determine whether they can receive the benefit.

DOD policy allows service members who believe they may qualify for the benefit, but haven’t been screened as eligible, to apply on their own. They should contact their financial counselors for help.

Retirement and continuation pay

All service members entering the military are automatically enrolled in the Blended Retirement System, or BRS. Only those who served before 2018 remain in the legacy, all-or-nothing 20-year pension plan.

BRS combines the traditional monthly retirement checks of the legacy system with new features that let military members take some government benefits with them, even if they don’t serve for 20 years to qualify for a pension. Historically, only 19% of active duty troops and 14% of Guardsmen and reservists in the legacy system stayed in uniform long enough to earn retirement benefits.

More than 400,000 eligible service members opted into the new BRS in 2018, out of the 1.6 million current active duty and Reserve troops who were eligible to choose between the legacy system and the new one.

Whether you opted into the BRS or were automatically enrolled, pay attention to the key elements of the BRS — it’s a critical part of your financial future.

Retirement pay

Under the BRS, you’ll get the traditional monthly retirement pay for life if you serve for at least 20 years to earn a full retirement from the military. But monthly payments under the BRS are 20% smaller than in the legacy system.

For BRS participants who retire after 20 years of active duty service, retirement pay is tallied by averaging the 36 highest months of active duty pay received while in uniform, then calculating 40% of that average. That percentage increases by 2% for each additional year of service. (The legacy benefit provided 50% of the highest 36 months of pay.)

Retirement pay also includes an annual cost-of-living adjustment.

Thrift Savings Plan

The Thrift Savings Plan, or TSP, is like a private-sector 401(k) retirement savings account. The government began matching user contributions in 2018. Now, while troops always have ownership of the money they put toward a TSP, they can’t access the funds contributed by DOD until they’ve served for at least two years.

Here’s how it works: A TSP account will be created after you have served for 60 days, and 3% of your basic pay is automatically deducted from each paycheck to fund it. (You can change that amount, but by law, you will be re-enrolled at 3% each year.)

DOD will automatically match 1% of that base pay, but can kick in as much as 5%. To make the most of your benefits, make sure you’re contributing at least 5% to your TSP to get the matching federal contribution of 5% as well. Why turn down free money?

If they’d like, troops can contribute more than 5%, up to a limit of $23,000 in 2024. For those with civilian retirement accounts such as a 401(k), as well as a TSP, contribution limits apply to the combined amounts.

Continuation pay

When troops hit 12 years of service, they qualify for another kind of money: continuation pay. To receive that one-time payout, which is similar to a retention bonus, a person must commit to stay in their service branch for four more years.

Here’s what that means for active duty, Guard and Reserve troops in each service in 2024:

- Air Force and Space Force: Continuation pay equals 2.5 times the monthly basic pay an active duty airman or guardian earned on the first day of their 12th year of service; Air Force Reservists and Air National Guardsmen earn half of their monthly pay

- Navy: Continuation pay equals 2.5 times the monthly basic pay an active duty sailor earned on the first day of their 12th year of service; Navy Reservists earn half of their monthly pay

- Marine Corps: Active duty Marines receive five times their monthly basic pay; reservists earn a full month’s pay

- Army: The Army had not finalized its continuation pay rates as of press time

It’s each service’s prerogative to adjust that multiplier to meet retention needs and other requirements. Continuation pay is taxable. You can receive it in a lump sum or, to help reduce the tax burden, receive it in four equal installments over four years. You can also contribute all or part of it to your TSP.

Lump sum retirement pay option

When you leave military service under the Blended Retirement System, you can ask for the retirement pay you’d earn until you reach full Social Security retirement age (for most people, that’s 67) as a lump sum.

Here’s how the lump sum is calculated: First, the federal government takes the full monthly pay available to a retiree and reduces it by a percentage that changes yearly. For 2024, it’s a 6.26% cut. Then retirees can take either 25% or 50% of that smaller pot as a single installment; the rest would stay as monthly paychecks.

For instance, if someone retires at age 40, their lump sum would equal one-quarter or half of that reduced amount of total retirement pay they would otherwise receive monthly between ages 40-67. They would receive that lump sum in addition to smaller monthly payouts. Then their retirement checks would return to their full monthly amount starting at age 67.

The lump sum is taxable; retirees can choose to receive the money in up to four installments over four years to reduce the tax burden.

You can find more information about BRS via the Defense Department.

Tricare

The 9.6 million Tricare beneficiaries can expect some important changes in the Department of Defense health care program within the next few years. New Tricare contracts are expected to be implemented starting on Jan. 1, 2025. The new contractor for the West Region is TriWest Healthcare Alliance. Humana Government Business, the incumbent contractor for Tricare’s East Region, will continue in that role.

When those contracts take effect, an additional 1.5 million beneficiaries will transfer to the West Region from six states in the East Region: Arkansas, Illinois, Louisiana, Oklahoma, Texas and Wisconsin. The West Region will cover 26 states.

Beneficiaries don’t need to take any action now; the contractors will notify beneficiaries of any action they need to take.

The new contracts will bring improvements for beneficiaries, according to defense health officials, such as more efficient health care referral transfers between the two regions; greater provider network flexibility; improved beneficiary choice; and enhanced telehealth appointments.

Meanwhile, after years of forcing some military beneficiaries to seek medical care in the Tricare private sector network, the Defense Department wants to attract patients back to military treatment facilities.

Citing problems that have led to “chronically understaffed military treatment facilities and dental treatment facilities,” Deputy Secretary of Defense Kathleen Hicks has directed sweeping changes to boost staffing at medical facilities and increase access to care for beneficiaries.

Hicks laid out a plan to grow the number of patients who receive care in a military treatment facility by 7% by the end of 2026, compared to the number of beneficiaries in December 2022. That would mean 3.3 million people would be using the MTFs in three years, according to Military Times calculations.

For example, officials are conducting a comprehensive review of all medical manpower and staffing; and plan to shuffle medical personnel to boost capacity at a few key locations by July 1.

Beneficiaries’ increased costs in 2024

Some military families saw a rise in their health care costs in 2024. Generally speaking, if a Tricare beneficiary paid out of pocket for Tricare before, those costs went up. Active duty service members don’t have any out-of-pocket costs.

For those who make co-payments for covered services such as primary care visits, specialty care outpatient visits and urgent care, the co-pays generally went up by $1 to $3 a visit. And those who pay annual enrollment fees also saw increases. Annual deductibles increased for some, too, which means the families will pay more out of pocket before Tricare kicks in.

Pharmacy costs also increased for Tricare beneficiaries who get their prescriptions filled at a retail pharmacy or through the mail-order program, as increases set by a 2018 law went into effect. There aren’t co-payments for prescriptions filled at military pharmacies.

Active duty members pay nothing for their covered medications through military pharmacies, retail pharmacies in the Tricare network and through the home delivery benefit. The military pharmacy is still the lowest cost option for all military beneficiaries, because there’s no cost for covered generic and brand-name drugs at these pharmacies.

A new Tricare Pharmacy Home Delivery policy continues from 2023: You must approve each refill when you’re enrolled in the automatic refill program, so that you only receive the prescriptions you need. Express Scripts, the administrator of the program, will let you know by phone, email or text, that you have a refill coming up. You’ll log in to your account to confirm you want it.

Tricare expanded the telehealth program during the pandemic to make it easier for military beneficiaries to get care. It now covers telehealth visits over the phone as a permanent benefit. While there was a temporary waiver on patient costs for telehealth during the pandemic, patients now pay cost-shares and co-pays. Telehealth costs are like costs for in-person care.

Tricare also covers the use of secure video conferencing to provide medically necessary services, allowing patients to connect with a provider using a computer or smartphone.

Who’s eligible?

Tricare offers 11 different options, with choices depending on the status of the military sponsor and the geographic location. It is open to active duty members; military retirees; National Guard and Reserve members; spouses and children registered in the Defense Enrollment Eligibility Reporting System; and certain others, including some former military spouses and survivors, as well as Medal of Honor recipients and their immediate families.

Those entering the military or changing status (e.g., from active duty to retired) should make sure they and their eligible family members are enrolled in the Tricare program of their choice. Those who don’t enroll may only receive care at a military clinic or hospital on a space-available basis; medical care by civilian providers would not be covered. The one-month open season begins on the Monday of the second full week in November. During that time, you can enroll in a new Tricare Prime or Tricare Select plan or change your enrollment. If you’re satisfied with your current Tricare health plan you don’t have to take action.

The law overhauling Tricare included a strict limitation on switching plans outside of open season. The exception to that rule is if there is a qualifying life event, such as the birth or adoption of a child, a move to a new duty station, marriage or retirement. Open season doesn’t apply to active duty members, who have full health coverage, or to retirees who are in Tricare for Life.

By law, Tricare beneficiaries fall into one of two categories:

- Group A: Sponsors who entered the military before Jan. 1, 2018, and their dependents

- Group B: Sponsors who entered the military on or after Jan 1, 2018, and their dependents

Those in Group A and Group B have different enrollment fees and out-of-pocket costs.

Families of active duty, National Guard and Reserve service members— as well as guardsmen and reservists who aren’t on active duty — are eligible for the Tricare Dental Program, which requires separate enrollment.

Most retirees and their family members are eligible for dental and vision coverage under the Federal Employees Dental and Vision Insurance Program, or FEDVIP, which is administered by the Office of Personnel Management and also requires separate enrollment.

What are the options?

Tricare offers two core health care options: Tricare Prime and Tricare Select.

All active duty members are required to enroll in Tricare Prime; they pay nothing out of pocket. Active duty families can also enroll in Tricare Prime without an enrollment fee. Prime beneficiaries are assigned a primary care manager, or PCM, at their local military treatment facility or, if one is not available, they can select a PCM within the Tricare Prime civilian network. Specialty care is provided on referral by the PCM, either to specialists at a military facility or a civilian provider.

Tricare Select is similar to a traditional fee-for-service health plan. Patients can see any authorized provider they choose, but must pay a deductible and co-pays for visits. Patients pay lower out-of-pocket costs when they receive care from a provider within the Tricare network.

All Tricare programs have a cap on how much a family pays out of pocket each fiscal year, depending on the sponsor’s status and the type of Tricare program used.

The plans

- Tricare Prime: Similar to a health maintenance organization, Tricare Prime has lower out-of-pocket costs but requires enrollees to use network providers and coordinate care through a primary care manager — a doctor, nurse practitioner or medical team. It’s free to active duty members. Families enrolled in a Tricare Prime plan don’t have to pay enrollment fees or co-payments unless they use the point-of-service option or fill a prescription outside of a military pharmacy. Retirees must pay an annual enrollment fee (Group A retirees pay $363 for an individual or $726 for a family in 2024). Co-payments for medical visits are lower than other programs.

- Tricare Prime Remote: Service members who live and work more than 50 miles or an hour’s drive from the nearest military treatment facility must enroll in Tricare Prime Remote. Family members are eligible if they live with an enrolled service member in a qualifying location, or they may use Tricare Select.

- Tricare Prime Overseas: This is a managed-care option for active duty members and their command-sponsored family members in nonremote locations. They have assigned primary care managers at a military treatment facility who provide most care, and referrals for and coordination of specialty care. Tricare Prime Remote Overseas is a managed care option in designated remote overseas locations, with most care from an assigned primary care manager in the local provider network who provides referrals for specialty care. Activated National Guard and Reserve members and their families also may enroll in these options while the sponsor is on active duty; retirees and their families aren’t eligible.

- Tricare Select: This is a preferred-provider plan — authorized doctors, hospitals and other providers are paid a Tricare-allowable charge for each service performed. Costs are higher for out-of-network providers, and certain procedures require pre-authorization. There is no enrollment fee for active duty families. Group A working-age retirees were required to start paying monthly enrollment fees in 2021. Co-pays vary by status and type of care: An in-network primary care outpatient visit costs Group A retirees and their families $36 in Tricare Select, for example, while Group A active duty family members pay $27. Group B active duty family members pay $18.

- Tricare Reserve Select: Qualified Selected Reserve members can buy Tricare coverage when they are in drilling status — not while mobilized. The program offers coverage similar to Tricare Select.

- Tricare Retired Reserve: “Gray area” National Guard and Reserve retirees who have accumulated enough service to qualify for military retirement benefits, but have not reached the age at which they can begin drawing those benefits (usually age 60) can purchase this insurance, which offers coverage similar to Tricare Select.

- Tricare for Life: This wraparound program is for retirees and family members who are eligible for Tricare and Medicare. The provider files the claims with Medicare; Medicare pays its portion and then sends the claim to the Tricare for Life claims processor. Enrollees must enroll in Medicare Part A (free for those who paid Medicare taxes while working) and Part B (monthly premium required) to receive Tricare for Life.

- Tricare Young Adult: Unmarried dependent children who do not have private health insurance through an employer may remain in Tricare until age 26 under a parent’s coverage via TYA Select or TYA Prime. Premiums are required for both.

- U.S. Family Health Plan: Beneficiaries who live in one of six designated areas, can enroll in this as a Prime option. Those enrolled get all their care, including prescription drugs, from a primary care provider the beneficiary selects out of a network of private doctors affiliated with one of the not-for-profit health care systems in the plan. Beneficiaries don’t get care at military hospitals or clinics, or from Tricare network providers when enrolled in the U.S. Family Health Plan.

Action items

Beneficiaries must take action to enroll in a Tricare plan in order to be covered for civilian health care. Those who don’t enroll will only be able to get health care at a military clinic or hospital on a space-available basis.

To be eligible for any of the Tricare plans, beneficiaries must first be enrolled in the Defense Enrollment Eligibility Reporting System. Active duty members are automatically registered in DEERS when they join the military, but they must register eligible dependent family members. Service members should make sure the information is correct for their family members. Only military members can add or remove family members through the local ID card office.

Life insurance

The Department of Veterans Affairs launched a new life insurance program in 2023, called VALife, to expand life insurance options for disabled veterans. Those eligible are veterans age 80 and younger who have a VA service-connected disability rating — even if the rating is 0%.

There’s no time limit to apply for this program after getting the disability rating.

Veterans can get up to $40,000 in whole life insurance coverage, in $10,000 increments, and cash value that starts to add up two years after VA approves their application.

The amount of the monthly premium depends on the veteran’s age when they apply for the insurance and how much coverage. The premium won’t increase as long as they keep the VALife policy. For example, a veteran who is 18 when applying for the policy will pay $43.60 for the maximum $40,000 worth of coverage. A veteran who is 41 when applying will pay $91.20 a month for that maximum coverage.

It’s the first time VA has offered a new life insurance program in more than 50 years.

SGLI increase

Service members automatically received an extra $100,000 of life insurance coverage starting in March 2023, increasing the maximum Servicemembers’ Group Life Insurance coverage amount to $500,000. All service members automatically got the extra coverage, including those who had previously declined or reduced their Servicemembers’ Group Life Insurance, known as SGLI. The boost applies to all those eligible for SGLI, including active duty, Guard and Reserve members. SGLI is group term life insurance.

Troops pay a premium of $31 per month for $500,000 worth of coverage, which is deducted from their pay. That extra $100,000 of coverage costs them an extra $6 per month. The rate hasn’t changed; the cost is still 6 cents per $1,000 of insurance. The monthly premium includes $1 for Traumatic Injury Protection coverage (TSGLI).

SGLI coverage is offered in increments of $50,000. The monthly premium is the same regardless of the service member’s age or other factors.

If active duty service members want to decline or reduce their coverage, they can use the SGLI Online Enrollment System. Reservists with part-time SGLI coverage who want to reduce or decline their coverage should use Form SGLV 8286 and provide it to their personnel office.

It’s the first time the maximum SGLI coverage amount has increased since 2005.

The maximum coverage for Veterans’ Group Life Insurance, or VGLI, also increased to $500,000, also up by $100,000. That is not automatic. Eligible veterans must request it. Service members leaving the military on or after March 1, 2023 who had the maximum SGLI coverage can purchase VGLI coverage up to $500,000. There are certain time limits for purchasing VGLI policies after leaving the service, so troops need to do some cost comparisons before leaving the military. SGLI coverage doesn’t automatically carry over, and VGLI is more expensive than SGLI.

Veterans under age 60 who currently have $400,000 maximum VGLI coverage will be able to purchase additional coverage, in increments of $25,000, at specified anniversary dates.

VA offers other life insurance programs, such as the Family SGLI. A civilian spouse of a service member signed up for full-time SGLI is eligible for up to $100,000 worth of life insurance. They are automatically insured, and the premiums are deducted from the service member’s pay. The amount of the premium depends on the age of the spouse. For example, a spouse under age 35 pays $4.50 a month for the maximum $100,000 worth of coverage. A 45-year-old spouse pays $10 a month. Dependent children are provided $10,000 worth of coverage, at no cost.

Service members married to service members are eligible for their own maximum $500,000 SGLI coverage as well as up to $100,000 in Family SGLI coverage, but Family SGLI isn’t automatic. Their service member must request it through their enrollment system.

Find more information about life insurance options at the VA.

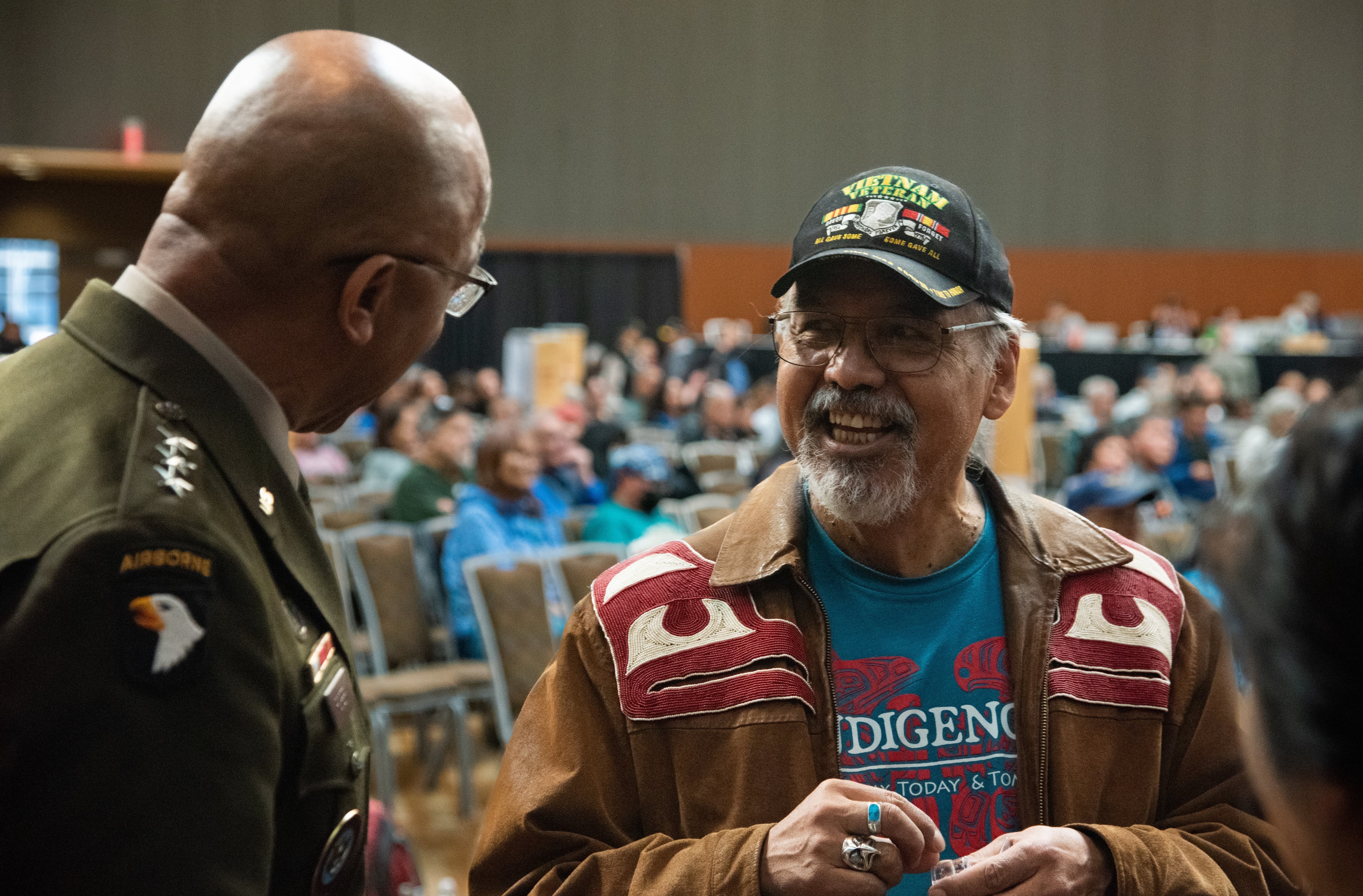

GI BILL AND TUITION ASSISTANCE

Post-9/11 GI Bill

The Post-9/11 GI Bill is a benefit for the latest generation of service members and veterans, as well as their eligible dependents. It includes payment of tuition and fees, a monthly housing allowance, and a stipend for textbooks and supplies.

The amount of time a veteran spends on active duty determines their benefit level. In general, the higher the level, the less individuals have to pay out of pocket for school. The benefit maxes out at full coverage of in-state tuition at public universities.

Here’s what veterans who received an honorable discharge after Sept. 10, 2001, are eligible for, based on the amount of time they’ve served:

- 100%: 36 months or more of active duty service, or discharged after at least 30 continuous days due to a service-connected disability

- 90%: 30–36 months

- 80%: 24–30 months

- 70%: 18–24 months

- 60%: 6–18 months

- 50%: 90 days–6 months

- No benefit: Fewer than 90 days

Veterans who served before Sept. 10, 2001, are not eligible for the Post-9/11 GI Bill.

Another deadline vets should be aware of: If someone’s service ended before Jan. 1, 2013, their Post-9/11 GI Bill benefits will expire 15 years after they last separated from active duty. If their service ended in 2013 or later, the benefit does not expire.

What it covers

Veterans can use the Post-9/11 GI Bill to pay for courses at a college, university, trade school, flight school or apprenticeship program.

While the benefit covers all in-state tuition and fees at public institutions, it may not have the same reach at a private or foreign school. The maximum tuition coverage for private nonprofit, private for-profit and foreign schools for the 2023-2024 school year was $27,120.05. That figure is expected to increase again in August.

Housing stipend

The housing stipends GI Bill users receive depend on the level of benefits they’re eligible for, how many courses they take and where they go to class.

The rate is determined by the Defense Department’s Basic Allowance for Housing scale and is paid at the same rate an active duty E-5 with dependents would receive in a particular area. If veterans are pursuing a degree entirely online, they will get half of the national BAH average.

Congress passed changes to the program at the start of the coronavirus pandemic to allow students forced online by campus closures and virus mitigation efforts to receive full housing benefits. Those protections have now expired, but could be used again in similar cases of national emergency under legislation enacted in 2022.

In the past, the Department of Veterans Affairs based the housing allowance on the location of a school’s main campus, even if a student took classes at a different branch. However, in 2019, the “Forever GI Bill” directed the VA to instead link the housing stipend to the location where a student attends most of their classes.

Transfer rules

Service members may transfer their benefits to a dependent, provided they have already served in the military for at least six years and agree to serve for four more after DOD approves the transfer.

The transfer must happen while an individual is still in uniform. Veterans who have already separated from the military are not eligible to transfer their benefits. Children are only eligible to start using the transferred benefits after the service member who gave them the funds has completed at least 10 years of service. Spouses can use the transferred benefits right away.

What’s new?

A pending court case could allow veterans who are eligible for both the Post-9/11 GI Bill and the Montgomery GI Bill to consecutively use both benefits, essentially giving some veterans another 12 months of education benefits. The Supreme Court is expected to rule on the case later this year.

The Montgomery GI Bill program preceded the Post-9/11 GI Bill and is being phased out. It offers far less money than the new program, but still can provide several thousands of dollars annually to veterans for tuition costs if they paid into the system at the start of their military service.

Active duty service members in August 2022 became eligible for the VA Yellow Ribbon program, which allows private schools to match VA benefits with their own tuition assistance.

More online

- Compare your GI Bill options with the VA’s GI Bill Comparison Tool.

- Veterans can apply for the Post-9/11 GI Bill online or by visiting their local VA regional office. If a beneficiary has already chosen a school or program, arrange a meeting with the institution’s VA certifying official, who can help get the process started.

RELATED

Tuition assistance

More education benefits are also available to service members.

While troops can begin to use their GI Bill benefits on active duty, their service branch can often help them pay for college by using tuition assistance first — saving the GI Bill for later.

TA is a federal benefit that covers the cost of tuition, up to certain limits, for active duty service members, as well as some members of the National Guard and Reserves. The military services directly pay those funds to schools. Generally, all service members must have enough time remaining in service to complete any courses in which they enroll.

Each service has its own requirements.

- Air Force: All officers incur a service requirement if they use TA, but there is no service-length requirement to begin using the benefit.

- Navy: Enlisted sailors and officers, including Navy Reservists, must have a minimum of three years of military service before becoming eligible to use TA.

- Army: Active duty officers incur a two-year service obligation if they enroll in classes. Reserve component officers incur a four-year service obligation.

- Marine Corps: After previously having to wait 18 to 24 months to use TA, Marines now have no minimum service-length requirements for the benefit. However, they must agree to at least two more years of active duty service to use the benefit.

- Coast Guard: Active duty members must have been on long-term active orders for more than 180 days to access TA. The Coast Guard also has unit-specific requirements and requires commanding officer approval.

- National Guard/Reserve: Soldiers who are activated or on drill status are eligible under the same conditions as active duty Army personnel. Air National Guardsmen and reservists of other branches are eligible for TA if they are activated, and the use of TA often comes with a service obligation once the last course is completed.

Limitations

All of the services cap tuition assistance at $250 per credit hour and $4,500 per fiscal year.

Generally, TA funds can be used to pursue a higher degree than what troops have already earned, up to a master’s degree. For instance, if someone has a bachelor’s degree, they can then pursue a graduate degree — not an associate degree or a second bachelor’s degree, though there are some exceptions.

Some branches require troops to create a degree plan or take a branch-specific course before TA benefits are approved.

Spouse and family support

Military families have many of the same needs as their civilian counterparts, but problems such as spouse unemployment and lack of child care are often exacerbated by the frequent moves and deployments that come with military life.

DOD and service officials have been working to improve quality of life for those families, especially by tackling spouse unemployment and child care shortages.

Bases worldwide offer families a wide variety of support services, from legal assistance and tax preparation to education and employment assistance, financial counseling, relocation assistance and much more.

To find out more about what’s available, start with the family centers on military installations or MilitaryOneSource.mil, which offers additional assistance by phone or chat, 24 hours a day.

Most of the information on Military OneSource is available to the public, but some extra services are available for free to service members and their immediate family members, survivors of deceased service members, and certain others. Retiring or separating service members and their immediate family members can also use these services for one year after they leave the service.

Among those services are nonmedical counseling — available in person, by phone, secure chat or video session — as well as financial counseling, including free tax preparation and tax filing help. Spouse employment and education services, language translation services for documents, health and wellness coaching, child/youth behavioral counseling, and family life counseling are also available.

Spouse employment and education

Spouses can visit their installation’s family center for employment and education assistance. They can also visit the Spouse Education and Career Opportunities, or SECO, section at MilitaryOneSource.mil for information about scholarships and other education and employment needs. SECO offers a free, personalized benefit through certified career counselors to help spouses investigate career options, education options or entrepreneurial projects.

Through DOD’s My Career Advancement Account program, or MyCAA, spouses of certain junior service members can receive tuition assistance of up to $4,000, with an annual cap of $2,000, to pursue licenses, certifications or associate degrees needed for employment in any career field or occupation. Spouses may also use their MyCAA scholarship at an approved institution to help with the costs of national tests for course credits required for a degree approved under the MyCAA program.

This benefit is available to spouses of active duty members at the grades of E-1 to E-6, W-1 and W-2, and O-1 to O-3. DOD expanded the benefit in 2023 to spouses of members in paygrades E-6 and O-3, limited to the first 1,250 spouses in those two ranks per calendar year. Military spouses remain eligible for this financial assistance if their military sponsor is promoted beyond the eligible ranks, as long as they already have an approved education-and-training plan in place through the program.

Spouses can also search job opportunities on the Military Spouse Employment Partnership site, where hundreds of employers that have been vetted by the Defense Department are looking to hire military spouses.

More than 700 employers are MSEP partners. As the number has grown over the past decade, those employers have hired over more than 275,000 military spouses across every employment sector, according to DOD. A number of these employers have remote work opportunities. In addition, through Military OneSource, spouses can get a free one-year membership to FlexJobs, a career platform that specializes in flexible and remote job openings.

Many military spouses spend time and money getting new professional licenses when they move to a new state. It costs money to sit for exams, plus other fees and the potential of lost pay as they go through the relicensing process. To help with these expenses, the law allows service members to apply to their service branch for reimbursement of up to $1,000 for their spouse’s relicensing and recertification costs each time they relocate on military orders.

The Department of Labor offers information about state professional licensing requirements here — specifically for military spouses.

What’s new

States must recognize professional licenses from other states. A federal law that took effect in 2023 requires states to provide reciprocity of professional licenses, except for attorneys, to military spouses. But it remains to be seen how states are implementing the Military Spouse Licensing Relief Act.

The new law has helped at least one spouse prevail in federal court, after the woman sued Texas for blocking her ability to work as a school counselor.

A new paid fellowship program allows spouses to be placed with civilian companies seeking full-time employees. The Military Spouse Career Accelerator Pilot program is free to employers, and DOD will pay spouses during their 12-week fellowships. The program is entering its second year; about 250 companies had signed up to participate, bringing nearly 500 spouses into fellowships as of January.

The accelerator pilot is open to spouses of currently serving members of the Army, Navy, Marine Corps, Air Force and Space Force, to include the active, Reserve and National Guard components. The hope is that companies will hire the spouses at the end of their 12-week fellowships. To date, about 85% of participants have been offered full-time employment with their host companies.

Spouses interested in applying can visit Military OneSource Spouse Education and Career Opportunities.

Companies interested in hosting a military spouse fellow can learn more and sign up through the Hiring Our Heroes website. The fellowship program is administered by the U.S. Chamber of Commerce Foundation.

Child care

The Defense Department’s child care systems include more than 700 child development centers, facilities for school-age children and a number of family child care homes at more than 230 locations worldwide. All are required to adhere to DOD regulations. These programs are nationally recognized for their quality, and programs meet strict standards for curriculum, safety and health.

There has long been a shortage of affordable, good quality child care for military families, just as there is a shortage nationwide. Although the military is building more child development centers, officials argue the problem can’t be solved by construction alone and have launched various initiatives, like staffing incentives, to ease the care crunch.

Child care fees are set on a sliding scale based on total family income, to include spouse income and other sources, and are the same regardless of a child’s age. In January 2024, many military families saw a large and welcome decrease in those fees — in some cases, a cut of more than 40%, according to Military Times’ calculations.

Not all families have seen those costs dip. In the highest income bracket, now set at $160,001 and above, service members are paying $215 a week. That’s a 2% increase over the amount those in the highest income category previously paid.

Families can learn more about the child care options offered at or near their installation at the official DOD website, MilitaryChildCare.com. The website gives parents more visibility into the available child care slots at multiple installations in a given area, and allows them to register and apply for child care in advance. Families can submit unlimited requests for child care, and remain on waitlists for a preferred program even after being offered care elsewhere.

Working military families receive higher priority in child care programs under DOD policy. The policy also allows officials to displace children who are already in a child development program if their parents are in a lower-priority category, and the gaining family expects to be on a wait list for more than 45 days after the time they need care.

Other child care options

Military families may also find child care through family-run sites in on-base homes, which undergo rigorous certification, inspection and oversight. Any family-run child care provider on an installation who offers child care for other families’ kids for at least 10 hours a week must be certified through installation officials. Families can get lists of certified home day cares at their installation’s child development program office, and on the MilitaryChildCare.com website.

Military families can also find high-quality, subsidized child care in their local civilian community if care is not available on base. Families must register at the MilitaryChildCare.com website for fee assistance through the program, operated through the nonprofit Child Care Aware of America.

Another option for finding hourly and on-demand child care: Families can receive a paid subscription to a service that lets them search for child care providers through Military OneSource. DOD covers the cost of the subscription.

What’s new

In the last few years, Congress has authorized funding to build more child development centers — 16 in fiscal 2023, and nine in the fiscal 2024 defense policy law. It generally takes about five years to finish construction and open the facilities.

DOD and the services are looking at new ways to ease the child care shortage, such as streamlining the hiring process for new staff and offering workers better pay and benefits. Officials argue staffing shortages are a major factor in the scarcity of child care facilities.

Congress has also approved a DOD pilot program that provides fee assistance for in-home child care. It’s currently available in 11 regions, with limited spaces available. Find more information at MilitaryChildCare.com.

Tax-savings accounts for child care

To help ease the cost of child care for military families, DOD began offering the dependent care flexible spending account program. In 2023, service members for the first time could opt to have part of their pay set aside in a spending account in 2024 to reimburse eligible expenses.

Active duty members and Active Guard Reserve members on Title 10 orders who pay for the care of an eligible dependent may use the benefit. Eligible dependents include children under age 13, or dependents of any age if they are physically or mentally incapable of caring for themselves.

This is a pre-tax benefit account used to help pay for eligible dependent care services, such as preschool, summer day camp, before or after school programs, and child or adult day care. Married couples filing joint tax returns can set aside $100 to $5,000 to help pay for those expenses. Since it’s deducted from your pay and put into your account before taxes, it reduces your overall tax burden. You submit claims for dependent care expenses to be reimbursed from that account.

You can enroll online through the Federal Flexible Spending Account Program, known as FSAFEDS, sponsored by the Office of Personnel Management.

Enrollment is available only during the annual Federal Benefits Open Season — mid-November through mid-December — or when experiencing a qualifying life event such as the birth or adoption of a child.

Service members enrolled in the program last fall are now submitting claims for reimbursement. Be aware that any funds in your account that you don’t use within certain federal deadlines are forfeited. If you don’t use all the money you’ve contributed to your account by Dec. 31, 2024, you’ll have until March 15, 2025 to use the funds for qualified expenses. Claims must be submitted by April 30, 2025 for dependent care expenses.

VA Home Loans

The Department of Veterans Affairs home loan program has been used by millions of service members and veterans since it took shape near the end of World War II. It’s one of the most popular benefits for veterans: Lenders issued 400,692 VA-backed loans totaling nearly $145 billion in 2023, with an average loan amount of $360,863, according to the VA.

The basics

The VA doesn’t issue the loans themselves, but backs loans issued by financial institutions. The VA guarantees a percentage of an eligible beneficiary’s loan to purchase or refinance a home, allowing the lender to provide better, more affordable terms and often letting the borrower seal the deal without a big cash-down payment.

Eligible service members and veterans can apply for home-purchase loans via private-sector lenders. There are no VA loan limits for veterans who have the full entitlement. For a VA-backed home loan, you’ll still need to meet your lender’s credit and income loan requirements in order to receive financing. These VA home purchase loans can be used to buy manufactured homes or homes under construction, in some cases, but not mobile homes.

The VA loan program also offers cash-out refinance loans.

An Interest Rate Reduction Refinance Loan may be able to reduce the rate on an existing VA-backed loan, or can make the payments more stable by moving from an adjustable or variable interest rate to a fixed rate.

Fees

VA loans come with fees that vary by loan type and veteran status. Veterans using the benefit for the first time on a no-down-payment purchase loan pay a 2.15% fee, for example, while a veteran making a second cash-out refinance loan would pay a 3.3% fee. A full fee table is available through the VA.

Veterans who receive or are eligible for VA disability compensation, Purple Heart recipients and certain others are exempt from fees. Other loans — including joint loans, construction loans and loans to cover the cost of energy-efficient repairs — can also be backed by the VA. Consult your lender for more information.

Eligibility

VA loan eligibility does not expire, though the entitlement can only be used for the borrower’s place of residence (not a rental property). It can be reinstated after the loan is paid off or under other circumstances — another veteran can assume the loan, for instance.

Whether current or former troops are eligible for VA loans depends on how long they served and in which years.

Older veterans qualify for VA loans if they served on active duty for at least 90 days during these dates:

- Sept. 16, 1940–July 25, 1947

- June 27, 1950–Jan. 31, 1955

- Aug. 5, 1964–May 7, 1975 (begins Feb. 28, 1961 for those who served in Vietnam)

If a person’s service fell outside those date ranges, they may need 181 continuous days on active duty to qualify. That includes enlisted troops who separated on or before Sept. 7, 1980, and officers who separated on or before Oct. 16, 1981.

If a person’s service came after the above date ranges, they need 24 months of time on active duty — or less for certain discharges.

For loan purposes, VA considers Gulf War service to run Aug. 2, 1990 through present day. Service members from that time period must have completed 24 months of continuous active-duty service to be eligible, or at least 90 days for certain discharge statuses.

Troops who are currently on active duty become eligible for a VA loan after 90 days of service, for as long as they remain active. Eligibility now includes National Guard and Reserve members with at least 90 days of active service. Troops discharged for a service-connected disability are eligible, regardless of service length.

Foreclosure assistance

If a VA-guaranteed loan becomes delinquent, VA works with the borrower to avoid foreclosure, including providing financial counseling. In some cases, that involves direct intervention with a mortgage loan servicer for the borrower.

In 2023, the VA helped more than 145,000 VA borrowers keep their homes. Find more information on home-loan assistance at the VA.

Action items

The key step for service members and veterans is to obtain a Certificate of Eligibility, either through the eBenefits site or via their lender, to be eligible for a VA-backed loan.

Those seeking to refinance existing loans should read lenders’ advertising material carefully: VA and the Consumer Financial Protection Bureau have warned of deceptive lending practices. Among the red flags are aggressive sales tactics, low interest rates with unspecified terms, and promises that borrowers can skip a mortgage payment as part of the new loan — a practice prohibited by VA.

Some veterans have experienced difficulty in using their VA loan benefit, especially in competitive housing markets in which multiple bids are made on houses. VA officials have said that misperceptions still persist among sellers and agents that VA financing is less desirable than conventional loans. Those in the industry have recommended that veterans question their real estate agents and lenders about their experience and how often they’ve helped veterans use their VA loan benefit.

What’s new

Veterans still struggle to make their loan payments. VA has “strongly urged” a moratorium on foreclosures through May 31, 2024 as they work with loan servicers to find solutions. The moratorium doesn’t apply to vacant or abandoned properties.

VA is also extending the COVID-19 Refund Modification program through May 31. The program aims to help veterans keep their homes by allowing VA to purchase part of their loan, creating a non-interest-bearing second mortgage.

For more information, such as eligibility details, visit VA’s home loan page or call 877-827-3702.

Military stores

Two benefits that help those in the military community stretch their dollars are commissaries and exchanges.

Commissaries are on-base stores that sell discounted groceries to authorized customers.

Exchanges are on-base stores (with an online component) that sell a variety of items ranging from clothing to shoes, toys, furniture, home appliances and electronics. They also have on-base gas stations and stores that sell alcoholic beverages.

Over the past few years, eligibility to shop at military commissaries and exchanges has expanded to include more people in the military community.

As always, it pays to compare prices between military stores and other stores.

Commissaries

Those eligible to use the commissary include active duty, Guard and Reserve members, military retirees, Medal of Honor recipients, and their authorized family members. These shoppers have military-issued IDs. In a recent change, commissary employees can also shop at the stories, but not their family members. Military and Coast Guard civilian employees in the U.S. and on service agreements overseas are also authorized shoppers.

In 2020, eligibility was expanded to veterans with service-connected disabilities, Purple Heart recipients, former prisoners of war, and primary family caregivers of eligible veterans enrolled under the VA’s Program of Comprehensive Assistance for Family Caregivers. Eligible veterans can use their veterans health ID card, or VHIC, to gain access to the installation and to shop. Spouses and other family members aren’t allowed to shop, though they are allowed to come into the stores with the veteran. Family caregivers who qualify for the benefit will have access to a memo at VA.gov which can be used for entry, along with a driver’s license, passport or other authorized form of ID.

Payment accepted: Cash, personal checks, travelers checks, money orders, debit cards, Military Star card, American Express, MasterCard, Visa and Discover credit cards, Temporary Assistance to Needy Families (TANF), Supplemental Nutrition Assistance Program, Women, Infants and Children (WIC), American Red Cross Disbursing Orders, commissary gift cards and coupons.

What’s new

In an effort to help service members and families deal with rising food costs, the Defense Department has invested in commissaries to decrease the price of most grocery items by about 3 to 5%. This effort is focused particularly on food staples like bread, milk, eggs and other items. Officials aim to increase overall commissary savings to 25%, compared to stores outside the gate. Before the extra funding, the overall savings were an average of 22%. Customers also pay a 5% surcharge which is used to cover construction costs and other needs.

Officials have taken other steps to boost the benefit, such as expanding hours of operation. That includes 56 stores that have converted from six- to seven-day operations.

Click2Go: The commissary agency finished rolling out its Click2Go program to all commissaries worldwide in the fall of 2021. Customers choose their items online, select a pickup time, and at the appointed time, head to the Click2Go parking spaces where commissary employees bring their groceries to their car and finish the transaction.

Doorstep delivery: As part of the Click2Go program, commissary officials have been testing doorstep delivery at eight locations in the continental U.S. where authorized shoppers who live within 20 miles can order groceries to be delivered. The delivery fee has been increased, from about $4 previously. It’s set by the contractor providing the delivery service, and depends on the miles from the commissary. For example, at Fort Belvoir, Virginia, the delivery fee is $15.99 for those within a one- to five-mile driving radius; and $29.99 for those within 16 to 20 miles. That’s in addition to tips customers might provide for the delivery driver. As of this writing, the future of the doorstep delivery isn’t clear, although commissary officials have said they’re working to expand the program and offer it at more locations.

Sales restrictions: A limited number of commissaries — 26 — sell beer and wine. Commissaries do sell tobacco in stores on Army and Air Force bases. DOD policy is that tobacco can’t be sold at a discount greater than 5% below the lowest competitor in the local area.

Rules on who can use overseas commissaries are affected by status-of-forces agreements between host nations and the U.S. The exact terms vary by country, and individuals should check with the local U.S. military command or installation they plan to visit before they travel.

Most commissaries have evening and weekend hours. To find a store, and get information such as hours and directions, go to the commissary website and click on “Store Locator.”

Exchanges

Exchanges are the military’s version of department stores, selling discounted brand-name goods from civilian companies, as well as their own private label items. There is no sales tax.

There are four exchange systems: The Navy Exchange Service Command; the Marine Corps Exchange system; Coast Guard Exchange system; and Army and Air Force Exchange Service, also known as The Exchange or AAFES. Eligible exchange shoppers can shop at any of the stores, regardless of the service branch, including their online stores at shopmyexchange.com, mynavyexchange.com, mymcx.com and shopcgx.com.

Stores support themselves almost completely through their sales income. All profits are used to fund military Morale, Welfare and Recreation programs, and to build or renovate stores.

Eligible shoppers include all ranks of active duty, retired, National Guard and Reserve members and their families, Medal of Honor recipients, and their families, surviving spouses and former spouses.

In 2021, defense officials expanded U.S. exchange shopping eligibility to DOD and Coast Guard civilians.

In 2020, the exchange benefit was authorized by law for all veterans with VA service-connected disability ratings; Purple Heart recipients; veterans who are former prisoners of war; and primary family caregivers of eligible veterans under the VA caregiver program.

All honorably discharged veterans can shop online at the exchanges. The Veterans Online Shopping Benefit does not grant on-installation access, unless the veteran falls into another category, such as having a VA service-connected disability rating.

Restrictions: Overseas stores offer many U.S. products that may be difficult to find otherwise. Commands often impose shopping restrictions to limit the sale of U.S. goods on the illegal market.

Stateside and overseas exchanges accept MasterCard, Visa, American Express and Discover credit cards. Exchanges also offer their own credit plan through the joint-exchange Military STAR Card.

What’s new

On Jan. 1, AAFES outlets stopped selling alcohol late at night. No AAFES outlet can sell alcohol between the hours of 10 a.m. and 6 a.m. Operating hours depend on the location. The policy aligns with other military exchanges’ policies that prohibit sales of alcohol after 10 p.m.